💰 Microfinance & SACCOS Management System

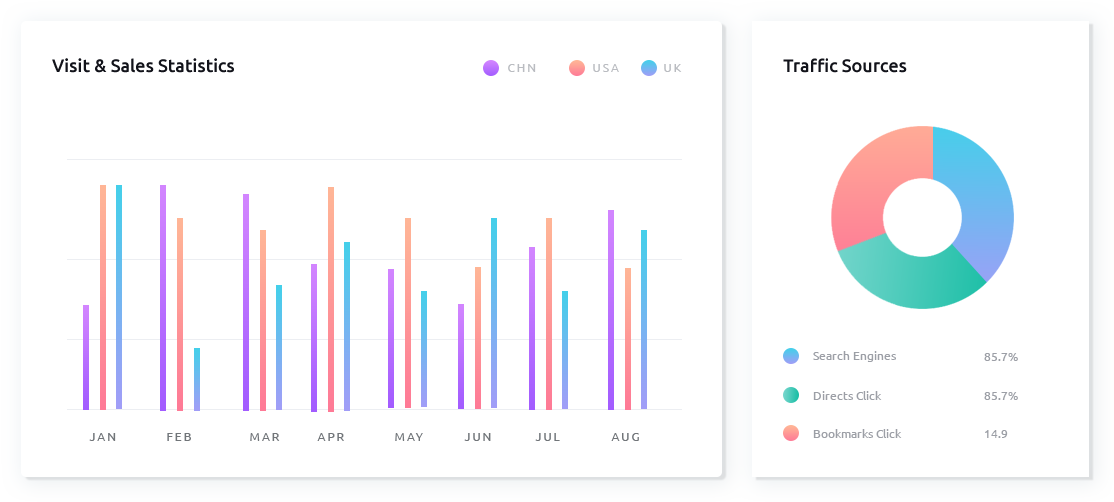

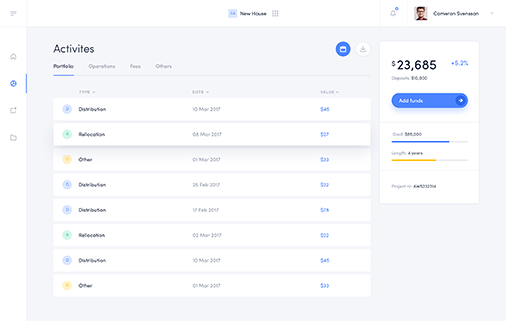

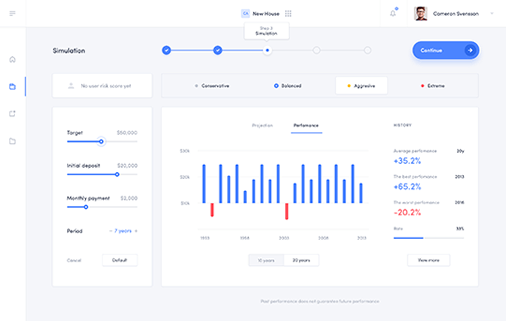

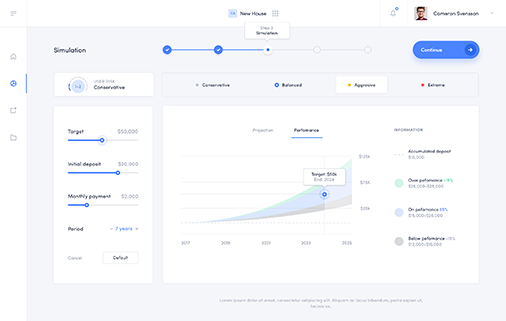

Deliver inclusive financial services across Tanzania and Africa. Our microfinance/SACCOS platform enables fast client onboarding, loan disbursement, group lending, digital repayments, portfolio analytics, and compliance tracking—all in a secure, cloud-based solution designed for financial inclusion.